Agriculture as a Pawn in Trump's Trade War

Rural America's Farm Country is going through some tough times. Trump's brand of trade and tariff policy are major contributors. Here's some things to keep in mind as you hear the stories.

President Donald Trump will roll out additional battles in his Trade War this week, announcing new tariffs on imported goods from additional trading countries. The Trade War is in high gear and will continue to shake up the economy.

In Trump’s view, and among national media, Trade War impacts on rural America will focus almost exclusively on agriculture. While agriculture is certainly a huge industry in rural, the debate will likely leave out the diverse people, places, and economic sectors that will also be impacted in rural. Some examples include tourism-driven economies, forest-dependent rural communities, rural clean energy projects, rural manufacturing regions, and more. That’s in addition to the likely large increases in consumer prices and corresponding economic pain.

Trump’s focus on rural = agriculture will put farmers and farming regions in the middle of the mess. Commodity prices—that’s what farmers who don’t sell food directly to people are paid for the crops and livestock that they grow—are likely to decrease. Input costs for imported fertilizers, equipment or equipment components, some seeds, and more are going to further increase. Farm families will struggle with higher prices for groceries and their costs-of-living.

While farmers of all sizes and in all regions are impacted, the “agriculture industry” made up of the Farm Bureau, commodity groups (like the National Cattlemen’s Beef Association and National Pork Producers Council), and their “partners” in corporate agribusiness are the at the center of the Trade War. Politically, the agriculture industry is almost 100% Team Trump. These “Monopoly Farmers” and their buddies in corporate board rooms make up one of the most hard-line free trade constituencies in the country.

{NOTE—That’s in spite of the fact that only around 20% of agricultural goods are exported. And the fact that nearly all farmers sell into the domestic market. Farmers themselves don’t export; multinational meatpackers, grain traders, and nut shippers who buy from U.S. farmers do the exporting. Though the two are related, the domestic price, not the export volume, is still what matters to farm income.)

To appease the Monopoly Farmers (approximately a mere 200,000 farms across the entire country) and corporate agribusiness, Trump will almost certainly announce another round of trade aid for farmers. (See today’s New York Times: “Ahead of President Trump’s plan to impose sweeping tariffs across the globe this week, his administration is weighing a new round of emergency aid to farmers, who are likely to be caught in the middle if America’s trading partners retaliate.”)

This Trump Agriculture Bailout 2.0 would keep the treadmill of industrial crop and livestock moving, even as Trump cancels and freezes funds for local farm and food infrastructure, conservation, and climate action projects that hundreds of thousands of farms are/were counting on to help with their operations. At the same time, Trump will be moving to halt antitrust policies and other actions to address corporate concentration and oligarch control over domestic markets. That’s a double whammy to the vast majority of farms nationwide. Trump and the agriculture industry don’t care about this farm majority. They often speak only of the largest industrial Monopoly Farmers as “real farmers.”

With that in mind, this edition features a number of maps and data tables to help inform the trade debate as it relates to the agriculture industry more broadly. At The Cocklebur, we believe that is important to understand how the food system works on the local, regional, domestic, and global levels. And, we believe that credible information should be at the center of good-faith policy discussions, though maybe that’s an old-fashioned idea.

In that spirit, here’s some U.S. agriculture trade data:

The U.S. is a net importer of agricultural goods:

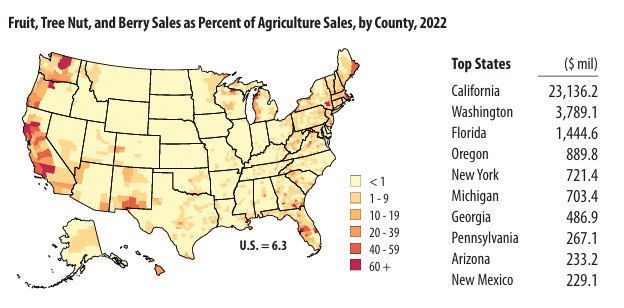

According to the U.S. Department of Agriculture’s (USDA) Economic Research Service (ERS), most U.S. agricultural imports are in the horticultural category: fruits, vegetables, spirits, wine, essential oils, tree nuts, and nursery stock. The U.S., on the other hand, tends to export a lot of grains and oilseeds (soybeans are the most prominent).

What agricultural products does agribusiness export?

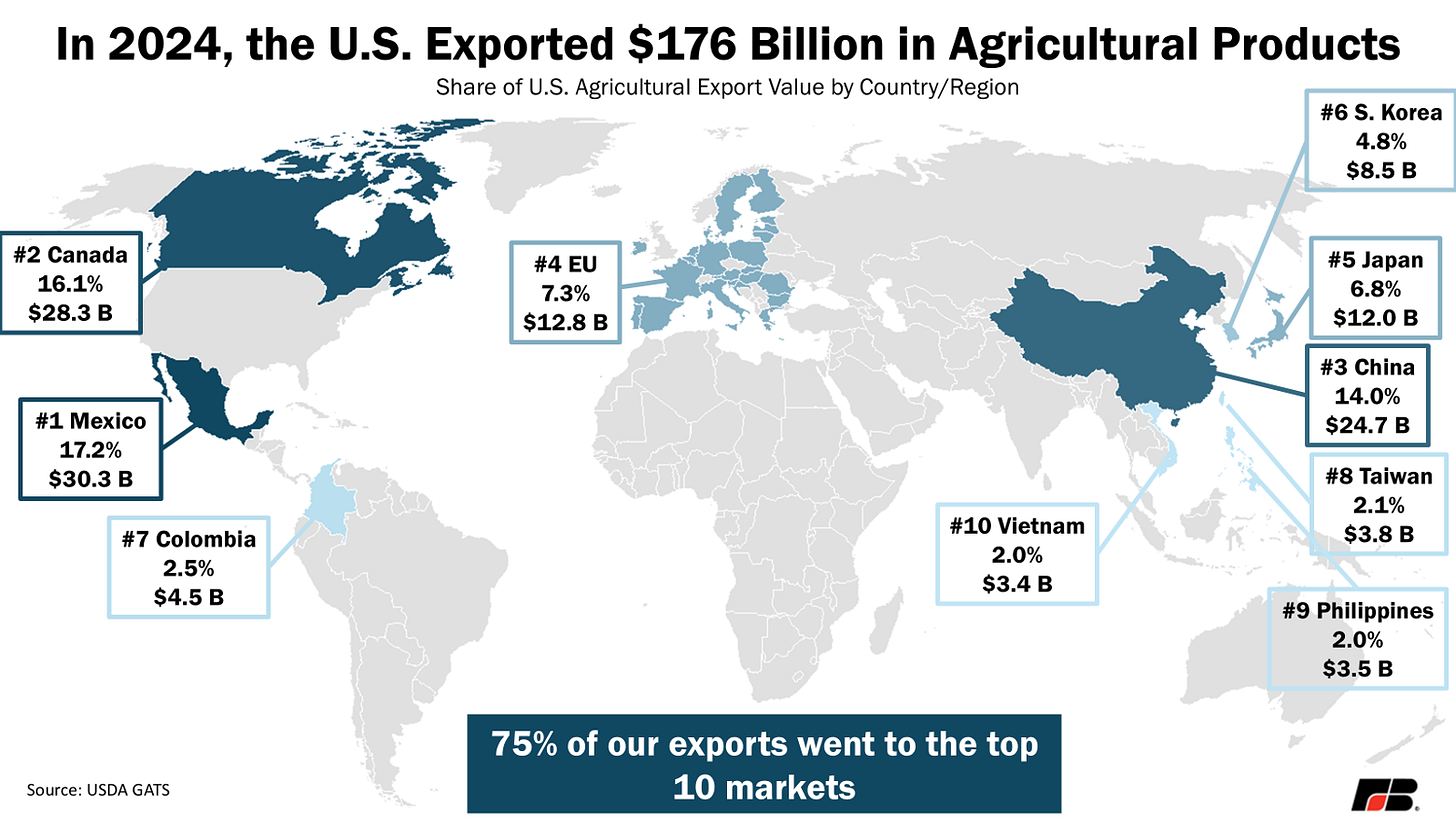

Where do agribusiness exports go?

The ERS states that the “top 5 markets for U.S. agricultural exports accounted for 64 percent of the total value of U.S. agricultural exports in fiscal year 2023. Exports to China were the largest share at $33.7 billion, followed by Mexico at $28.2 billion and Canada at $27.9 billion. The European Union trailed behind these numbers at $12.3 billion, slightly overtaking Japan at $12.2 billion.”

Where do U.S. agricultural imports come from?

“Canada and Mexico are the United States' first and third largest suppliers of agricultural products (averaging $30.9 billion and $25.5 billion in 2017–21, respectively),” according to ERA. “Mexico supplied the United States with 31 percent of imported horticultural products including fruit, vegetables, and alcoholic beverages.” ERS reports that European Union is the second largest importer, amounting to $28.0 billion worth of U.S. agricultural imports in 2017–21, led by wine, spirits, and essential oils (60% of the value).

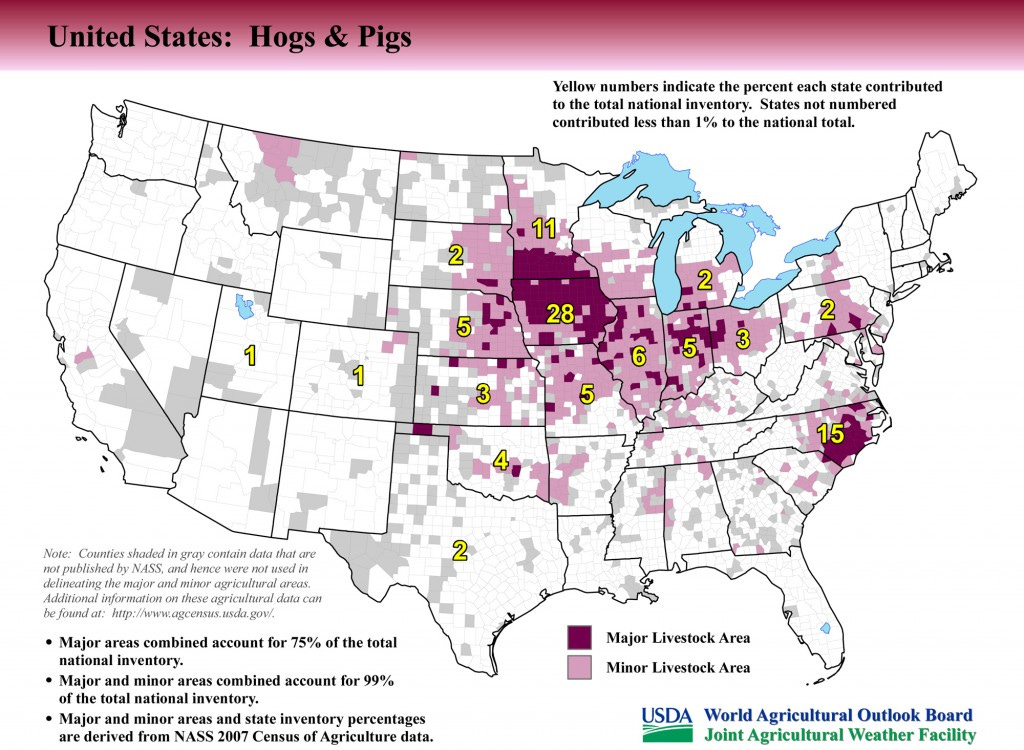

Where the Top 5 U.S. agricultural product exports are produced (2023 maps, 2024 not yet released).

The rural counties where farming is disproportionally driven by farming:

The Cocklebur covers rural policy and politics from a progressive point-of-view. Our work focuses on a tangled rural political reality of dishonest debate, economic and racial disparities, corporate power over our democracy, and disinformation peddled by conservative media outlets. We aim to use facts, data, and science to inform our point-of-view. We wear our complicated love/WTF relationship with rural America on our sleeve.