Big Ag Republicans Continue to Spout Big BS About the Estate Tax.

Republicans like to pretend that the federal estate tax is going to end the family farm. But USDA researchers estimate that far less than 1% of estates with farm assets have any estate tax liability.

Republicans in the U.S. House and Senate hell-bent on cutting taxes during the 2025 Congressional session have once again turned their attention toward one of their favorite straw men: the impending doom of the family farm due to the federal estate tax.

The GOP, as an outcome of focus-groups and polling by GOP consultant Frank Luntz, has re-branded the long-standing tax on the richest of the rich as the “death tax.” Now, with their all-of-government majority, the Republican Congress is feeling confident they could finally pass their proposed Death Tax Repeal Act. Introduced by Representative Randy Feenstra (R-IA) and 170 co-sponsors in the House, and by Majority Leader John Thune (R-SD) and 45 co-sponsors in the Senate, Republicans are seeking to abolish the estate tax as part of a more comprehensive tax cut package they hope to pass this year.

The thing is, the entire estate tax debate is based upon misinformation, disinformation, and political hackery. Republican leaders constantly say things like:

“The last thing American families need is the IRS knocking on their door to collect a Death Tax as they grieve the loss of a loved one. However, this is the reality for too many family-owned farms and small businesses, putting generations of hard work in jeopardy. . . As a fourth-generation farm owner, who manages the same land my grandparents and great-grandparents did, I understand this fear plaguing family-owned businesses across the country. If the Trump tax cuts expire, 2 million family farms will see their Death Tax exemption slashed in half. Congress needs to take immediate action to permanently extend these tax cuts so America’s family farmers do not have to spend their time dialing up estate planners to help navigate the uncertainty. President Trump has ushered in a new golden age in American history, and that starts with helping the men and women who feed and fuel our country.”

— Representative Jason Smith (R-MO) Chair of the U.S. House Ways and Means Committee and co-sponsor of the “Death Tax Repeal Act.”

The data tells another story, however. The truth is that almost no one with farm assets ends up paying the estate tax.

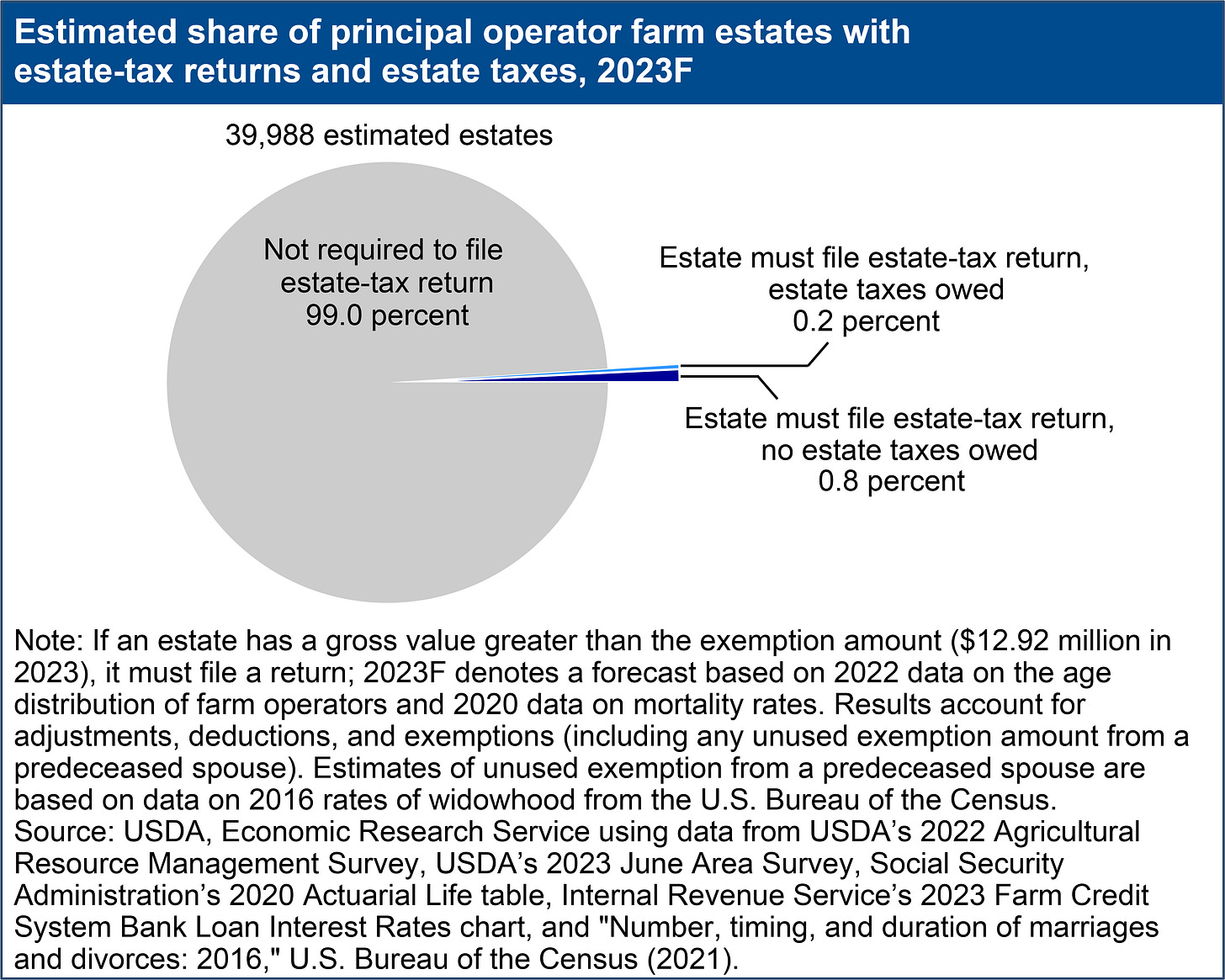

The most recent U.S. Department of Agriculture Economic Research Service (ERS) data—“Federal Tax Issues - Federal Estate Taxes”—finds that a meager 0.2% (2 farm estates out of 1,000) would have any estimated estate tax liability during the 2023 tax year. 2 out of 1,000. The richest of the rich. The wealthiest of the wealthy.

The ERS report finds:

“For 2023, USDA, Economic Research Service (ERS) estimated 39,988 estates would result from principal operator deaths, and out of those, approximately 0.8 percent—or 330 estates—would be required to file an estate tax return but would not owe estate tax. About another 0.2 percent—or 89 estates—would be required to file an estate tax return and would owe estate tax.”

89 estates. The richest 0.2% of farmers. That’s a long ways from an “existential crisis” that threatens family farm survival.

If the Republicans are not able to extend the 2017 Trump Tax Cuts (the Tax Cuts and Jobs Act) by the end of the year, the estate tax exemption will go down to approximately $7 million. ERS estimates that the number of farm estates owing Federal estate tax would increase to approximately 1.0%, and net Federal estate tax collections would grow from $572 million to $1.2 billion.

1.0% is a long ways from 100%. And besides, the richest 1% of farmers have plenty of money to hire accountants and lawyers for estate tax work-arounds.

Still, it seems likely that the “Death Tax Repeal Act” will be added to Republican tax cut plans this year, further decreasing tax revenues paid by the rich and increasing federal debt and deficits.

NOTE—I know this is a rather short and curt post. I have a lot more to say about this topic, but this issue gets my dander up. I have been working on federal farm, food, rural economy, and budget issues since the late 1990s. The bogus estate tax claims of Republicans, the Farm Bureau, and other corporate agribusiness interests have been hovering in the air around Washington, DC, during my entire career. It’s yet another non-issue designed to scare, intimidate, and/or mislead policymakers, Beltway staffers + pundits, and media from real issues like growing wealth inequality and power over decision-making in our democracy. My opinion is that if you’re worried about the estate tax, and you’re not comfortable with inheriting a nearly $14 million tax-free advantage over the 99%+ of us, I think you should have your taxes increased. That would help pay for things like:

1.) My Grandma’s nursing home bills and her prescription drugs.

2.) My parents’ Social Security (and their prescription drugs).

3.) My ability to access nonpartisan, publicly-available science, and research at USDA and other agencies necessary for decent reporting (and my prescription drugs).

4.) My sons’ college tuition and their many years of health coverage through Medicaid.

5.) Highways, bridges, Amtrak, National Parks and other public lands, high speed internet and electricity in rural America, freely available weather forecasts . . . . Etc.

There’s too much to list, but you get the point.

—Bryce, Publisher of The Cocklebur

The Cocklebur covers rural policy and politics from a progressive point-of-view. Our work focuses on a tangled rural political reality of dishonest debate, economic and racial disparities, corporate power over our democracy, and disinformation peddled by conservative media outlets. We aim to use facts, data, and science to inform our point-of-view. We wear our complicated love/WTF relationship with rural America on our sleeve.

If you started coverage of this issue in 1990 then you should have knowledge that a problem did exist with the exemption amount allowed before Estate Taxes were due. This chart https://resources.evans-legal.com/?p=3627 shows that at one time it was not keeping pace with the rise in farm land values. Adjustments were needed because a 250-300 acre family farm with equipment assets would exceed the limit and in many cases, lacked cash to pay Estate Taxes. Prior to the Tax Cuts and Jobs Act the exemption was $5.4 million and that did protect small farming operations. I agree that we could go back to that level, even though I’m not a fan of Estate Taxes. I tend to agree that it is a double tax in many cases. The Republicans are only interested in helping the top 1%, it a lie that they are looking out for “small family farms”.