House Republican Budget Proposal: Cut Taxes for the Rich, Punish the Poor.

GOP House leaders would cut health care and food assistance benefits by $1.1 Trillion over the next decade to pay for tax cuts for billionaires/corporations. The cuts would devastate rural America.

House Republicans released their FY 2025 budget reconciliation proposal Wednesday (2-12-2025), calling for $4.5 trillion in tax cuts and $2.5 trillion in spending cuts over the next decade. The House proposal is a “one big bill” attempt to pass a budget for this year and to extend/expand the 2017 Trump Tax Cuts and Jobs Act. The bill would also increase the federal debt ceiling by $4 trillion, creating additional room in the debt to “pay-for” expensive tax cuts that primarily benefit the richest people.

The Senate Budget Committee passed their first of a likely two-bill approach yesterday, proposing $342 billion for border, military, and energy funding in the next four years. Senate Republicans say that they will address tax cuts in future legislation.

The House and Senate will have to come to an agreement on a final FY 2025 budget package, or extend the FY 2024, before the March 14 government shutdown deadline.

The House proposal targets two of the most important federal programs that serve rural people while supporting rural economies:

Orders $230 billion in cuts to the House Agriculture Committee—House Agriculture Committee Republicans have long called for deep cuts to SNAP (the Supplemental Nutrition Assistance Programs formerly known as food stamps). SNAP cuts would be one of the only ways to achieve $230 billion in budget reductions over the next decade. These cuts would have a disproportionately negative impact on rural household food security.

Orders $880 billion in cuts to House Ways and Means Committee—Republican leaders in the House Ways and Means Committee would likely try to cut Medicaid to achieve this level of budget reductions over the next decade. Medicaid cuts would have negative health outcomes and increase the number of uninsured people throughout rural America, especially in states that have participated in the Affordable Care Act’s (ACA) Medicaid expansion program.

SNAP Cuts in Rural:

Rural America has larger SNAP participation rates than metropolitan counties. A 2021 FRAC analysis found that 14.4% of rural households participate in SNAP, while small town counties (13.8%) and metropolitan counties (11.3%) had lower participation rates. An estimated 2.5 million rural households depend on SNAP to help pay for groceries.

In addition to providing monthly benefits to help pay for food, SNAP benefits help to sustain many rural grocery stores. SNAP benefits can make up large percentages of grocery sales and help to retain local jobs. USDA researchers have found that $1 dollar in food stamps generates $1.79 in additional economic activity. The 2010 report estimates that every $1 billion in SNAP spending was responsible for creating 10,000 full-time-equivalent jobs, including about 1,000 jobs in the ag industry. More recent updates have found an economy-wide multiplier of $1.54 for every $1 of SNAP benefits.

Republicans would likely use several strategies in their crusade to reduce SNAP grocery benefits by $230 billion over the next decade. There are proposals to expand work requirements and/or to limit what foods can be purchased with SNAP benefit cards. But the most important issue is addressing how the monthly benefit amount is determined.

In 2021, the Biden Administration updated the “Thrifty Food Plan,” the mechanism that determines minimum cost for a healthy diet. The update was the first substantive change since the 1970s, and resulted in a 23% increase in benefits. Rolling back those benefits would cut SNAP spending by $250 billion, according to the Center on Budget and Policy Priorities.

CBPP developed the following list of consequences that these proposed cuts could mean:

Medicaid Cuts in Rural:

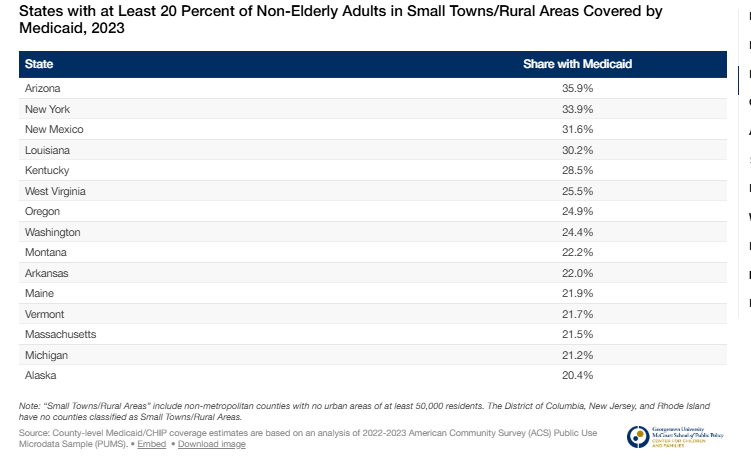

A recent Georgetown University study, “Medicaid’s Role in Small Towns and Rural Areas,” found that cutting Medicaid would have a negative impact on rural communities and small towns. A larger portion of rural populations depend on Medicaid than in metropolitan areas. That’s because rural populations tend to be poorer and sicker than metropolitan populations.

The rural parts of the following states would be impacted most deeply by proposed Medicaid cuts, according to the Georgetown study:

One likely Republican proposal would be to eliminate state-based Medicaid expansion cost share payments from the federal government. Federal funds currently pay for 90% of Medicaid benefits, with states committing to paying for 10%. Most states have adopted Medicaid expansion.

The Kaiser Family Foundation (KFF) just issued this report, “Eliminating the Medicaid Expansion Federal Match Rate: State-by-State Estimates,” to help inform the current policy debate. In the scenario that states drop the ACA Medicaid expansion in response to the elimination of the 90% federal match rate, Medicaid spending across all states for a would “result in a 25% (or $1.7 trillion) decrease in federal Medicaid spending and a 5% (or $186 billion) decrease in state Medicaid spending” in the next decade. Medicaid spending would decrease by nearly one-fifth (or $1.9 trillion), and “nearly a quarter of all Medicaid enrollees (20 million people) would lose coverage.”

The House Budget Committee will be taking up the Republican Budget draft at 10am EST. The Hearing can be viewed HERE.

The Cocklebur covers rural policy and politics from a progressive point-of-view. Our work focuses on a tangled rural political reality of dishonest debate, economic and racial disparities, corporate power over our democracy, and disinformation peddled by conservative media outlets. We aim to use facts, data, and science to inform our point-of-view. We wear our complicated love/WTF relationship with rural America on our sleeve.

Family Farms and Small Businesses are the "E" In DEI Excellent video. I got an education from your article and this video!!! Great work. I hope farmers and people in general will wake up on this issue! https://youtu.be/Pj1rxI-d5wg?si=4LEqLTmVGP6-l4EZ